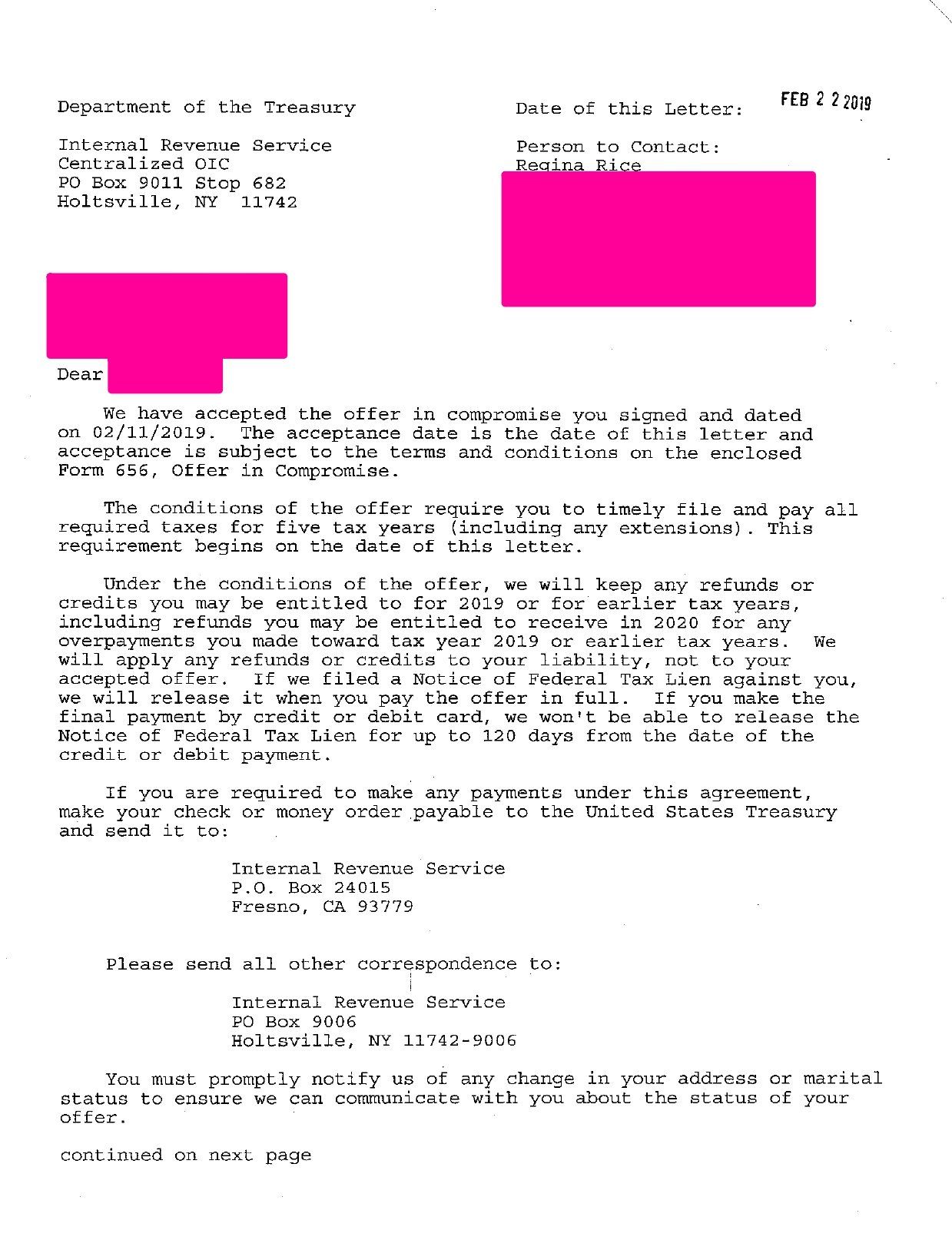

WE END IRS TAX PROBLEMS!

We are a full-service tax resolution firm that is ready to fight for you when tax problems threaten your future. Tax problems happen to

good people and we specialize in tax law. We know dealing with the IRS can be confusing, frustrating, and even scary. We've taken on the IRS and have succeeded in saving millions of dollars for our clients. You have choices when it comes to resolving your case with the IRS, get a company with an experienced tax attorney with over a decade over experience who wants to win for you.

AND WE LOVE WHAT WE DO

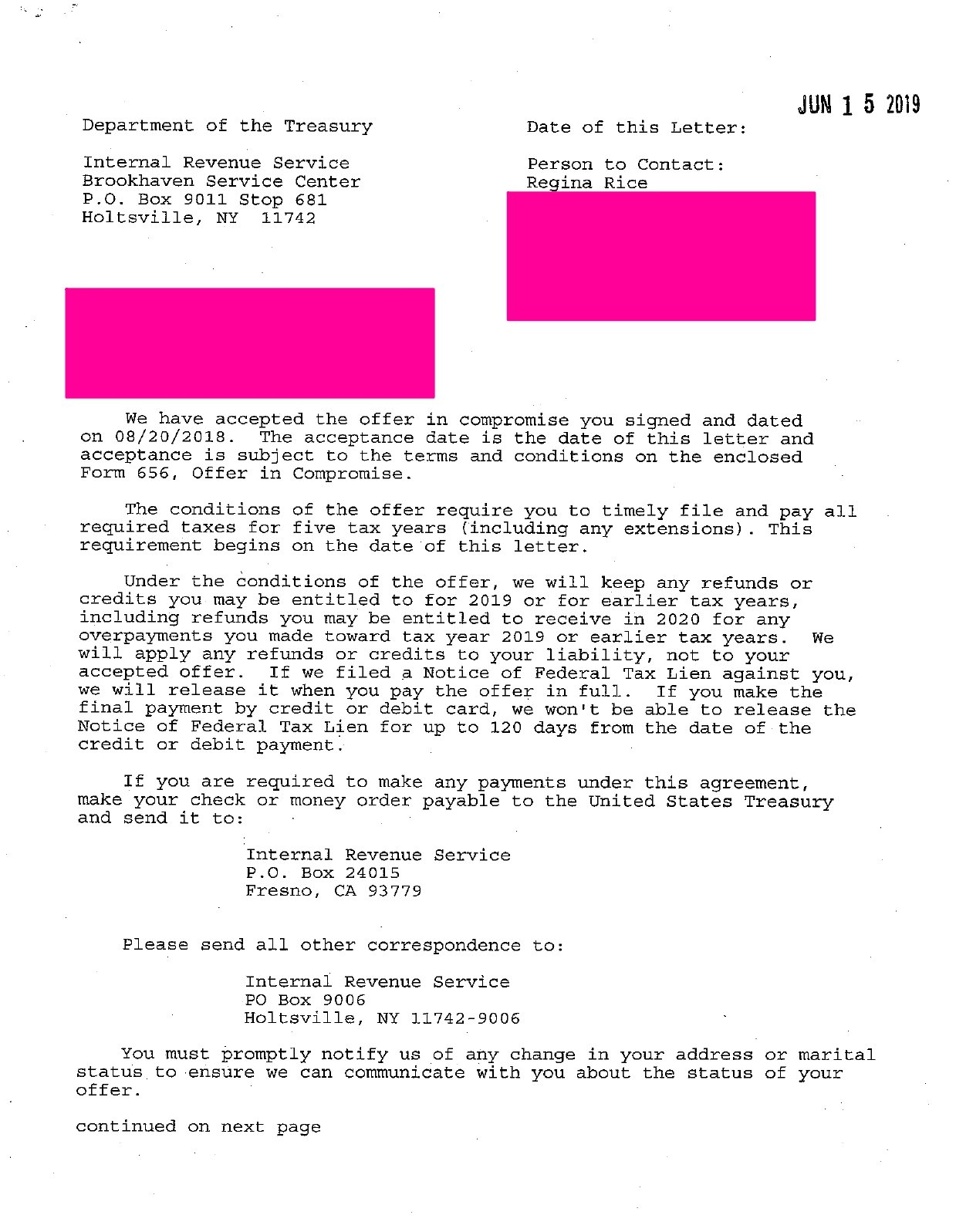

WE HELP

CLIENTS

Save Money

Whether it is tax preparation or tax resolution, we at Wolf Tax will save you money.

Save Time

Save time by letting us deal with talking to the IRS, handling the paper work and resolving your case.

Find Freedom

You can rest assured that we will keep you protected and get you the best resolution possible.

WHEN IT COMES TO YOUR TAXES

DO ANY OF THESE APPLY TO YOU?

- You owe money to the IRS

- You want to save money on taxes

- You are stressed

- You can't sleep

- You don't know where to start

- You don't know what to do

If you need help with any of these issues, call us or leave us a message for your free confidential consultation.

NO MATTER HOW DIFFICULT THE SITUATION

WE CAN RESOLVE YOUR TAX PROBLEM

AND

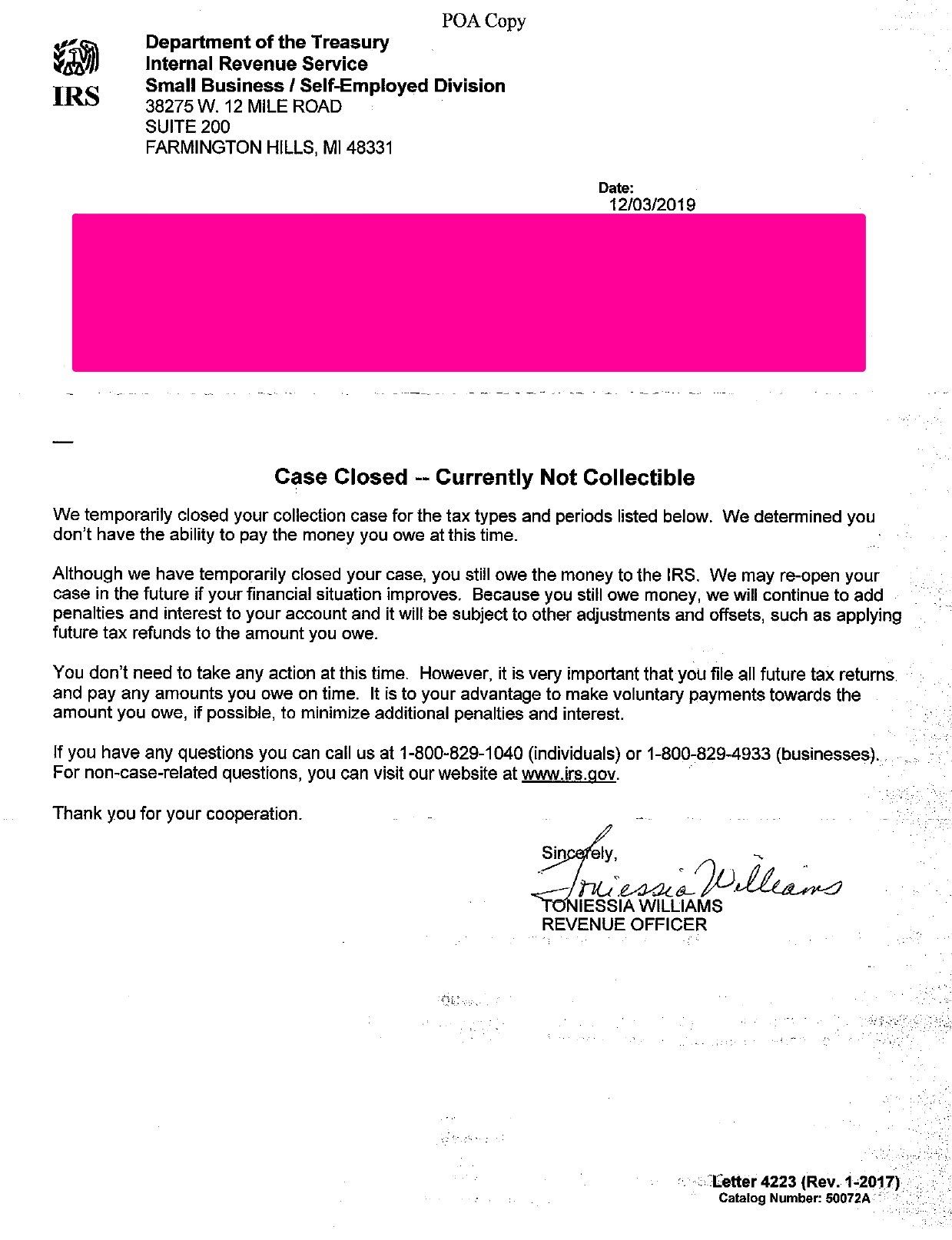

REAL REVIEWS

WHY

WE'RE DIFFERENT!

WE GENUINELY WANT TO HELP

We want you to become a client for life! We do not look for quick fixes, but permanent results. Give us a call to learn how we can help.

EXPERT ATTORNEY

Get an expert tax attorney that will professionally analyze and handle your case from the very beginning to the very end.

NO RISKS OR OBLIGATIONS

When you are done with your risk free assessment, you will have a complete understanding of how to fix your tax problem. You can then attempt to do it on your own or hire us.

FLAT FEE PRICING

We offer flat fee monthly pricing that is easy to understand, transparent and creates a system where we work together throughout the process to resolve your case.

TAX SAVINGS YOU WILL LOVE

Whether it is tax planning, tax preparation or tax planning, we are always looking to save our clients money and most of the time we do.